What Is Debt Defense?

Interesting high defination online streaming about eliminate Debt Fast, Cash Advance, Credit Debt, Debt Settlement Programs, and Has Secured Debt, What Is Debt Defense?.

… cards, secure debts such as foreclosure cases on a mortgage or collection matters on a secured debt like an automobile or general breach of contract actions.

Has Secured Debt, What Is Debt Defense?.

How To Leave The Debt Trap

On the other hand there are significant advantages to being Debt Free. Instead, learn to utilize your charge card appropriately. Numerous individuals trying to find debt consolidation have high charge card balances.

What Is Debt Defense?, Search popular videos related to Has Secured Debt.

6 Crucial Benefits Of Financial Obligation Consolidation

Is it an accident that we live a carefree life and do not believe enough about the future? I imply neglect what other individuals are DOING AROUND YOU. Plus, you will spend a lot on interest payments over the regard to the loan.

Debt consolidation includes the process of integrating many debts into one with just one regular monthly payment. Advantages include a lower regular monthly payment, lower rate of interest and fees and the cancelling of previous charges or charges for missed out on or late payments. How debt consolidation impacts somebody’s credit is really complex and everything depends on the approach that is selected for financial obligation consolidation. If financial obligation combination is refrained from doing effectively; it can in some cases do more damage to your credit.

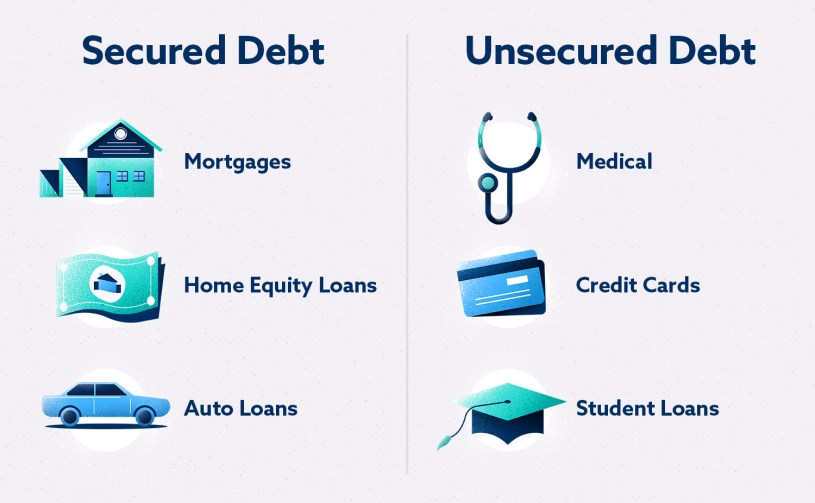

The very first thing you need to do is look at your debt. There are two sort of financial obligation. Secured Debt is the very first kind. Protected financial obligation is financial obligation that is connected to security. This could be the loan on your house or car. The 2nd type of financial obligation is unsecured financial obligation. This type of debt does not have actually collateral attached to it. This could be a charge card debt or a trainee loan. When you examine your debt, what kind do you have? Do you have protected or unsecured. There is a fantastic option to your problem if you have unsecured debt.

Customers with bad credit can likewise make an application for these loans because there is an asset connected to the loan. By removing all the financial obligations with the help of the loans, customer can enhance the credit score.

Life is often interrupted by something as unreasonable or as dramatic as the financial slump. Is it a mishap that we live a carefree life and do not think enough about the future? With all the lessons of the unpredictability of life we still see people who do not understand what is incorrect with living from income to income. With the failure to put something to retirement, and not remain committed to financial plans they feel they do not require to do to change. Debt Free life is a dream that is within the reach of the majority of people.

If you remain in a position where you can make only the minimum regular monthly payments on your Revolving Debt (typically charge card financial obligation), you need to stress – unless it’s simply a short-term situation. In lots of cases, the required minimum monthly payment will be just enough to cover your interest charges and will do absolutely nothing to lower your balances. You might literally never ever get out of debt if you continue to make simply the minimum regular monthly payments needed. In one example I saw just recently, the individual might leave debt making just the minimum monthly payments but it would take him 17 years.

When noting your financial obligations on your worksheet, make a note of the limitation of each credit card or other type of financial obligation and include these quantities approximately get your total possible financial obligation. You can find information about your limits on your statements. This will reveal you the total possible quantity of financial obligation you might have. Are you at the top of your limits? Or could you go even more much deeper into financial obligation? In either case now you know how bad it can get.

There is a big mistaken belief that credit is the only method to get the things we need and want out of life. People are over spending and living beyond their means. I’m not saying that you shouldn’t want good things, however you shouldn’t offer your soul to get them. If you permit it to be, $10,000 in credit card debt could quickly a 10-15 year duty. I desire you to see in your mind’s eyeborrowing $100.00 however repaying $1000.00 sounds crazy right? Well that’s why you require a financial obligation totally free service.

The result is the amount of money you must allocate each month for your Holiday Fund. We will also speak about how you can eliminate your charge card financial obligation later on. Debt backed or protected by security.

If you are looking unique and entertaining reviews about Has Secured Debt, and increase My Credit Score, Stay Debt Free, Credit Card Account, Eliminate Credit Card Debt please subscribe our newsletter now.