What is Credit? Basics of Credit | Money Instructor

Interesting full videos highly rated credit Card Debt Relief, How To Pay Off Debt, Debt Consolidation Company, and Is Installment Debt Better Than Revolving Debt, What is Credit? Basics of Credit | Money Instructor.

Learn what credit is and how it works, including the types of credit available and how to obtain it. Understand the importance of using credit responsibly and paying bills on time to maintain good credit standing and secure better interest rates and terms. Lesson presented in a entertaining kid friendly way. Credit 101. Definition of credit.

Credit is the ability to borrow money or obtain goods and services with the understanding that payment will be made later. There are two types of credit: revolving and installment. To obtain credit, you typically need to apply and provide information about your income, employment history, and credit score. Having good credit allows for better interest rates and terms, making it easier to secure funding necessary for achieving your financial goals. However, it’s essential to use credit responsibly and pay your bills on time to maintain a good credit score.

Visit us at MoneyInstructor.com ➡️https://www.moneyinstructor.com/

For more credit and credit card lessons and lesson plans:

https://www.moneyinstructor.com/creditcards.asp

SUBSCRIBE TO OUR YOUTUBE CHANNEL:

🔔https://www.youtube.com/c/moneyinstructor?sub_confirmation=1

RELATED VIDEOS:

➡️What is a Credit Card? https://youtu.be/6YyDlijCC_0

WEBSITE: https://www.moneyinstructor.com

TWITTER: https://twitter.com/moneyinstructor

FACEBOOK: https://www.facebook.com/MoneyInstructor

#credit

#creditscore

#financialeducation

#financialliteracy

#finance101

#debt

Is Installment Debt Better Than Revolving Debt, What is Credit? Basics of Credit | Money Instructor.

Are You Searching For A Way To Be Financial Obligation Totally Free?

You do not need to consume the finest meat every day and you sure don’t need to eat in restaurants. Everyone wants to be debt free but how is the question. It exists but no one desires to speak about it.

What is Credit? Basics of Credit | Money Instructor, Enjoy latest videos relevant with Is Installment Debt Better Than Revolving Debt.

Types Of Financial Obligation Management Programs That Can Work Well For You

Never let the overdue loan balance go beyond the original loan quantity. Analyze the reasons you utilize your charge card. However, to arrange your cash, set yourself a standard spending plan.

Lots of customers have actually significantly cut back on costs as their incomes outlooks have ended up being cloudier. As just recently as 2008, research studies revealed the typical cardholder has 7.6 cards. Sadly, although the costs has stopped, the debt collected in the last couple of years still has actually to be paid off.

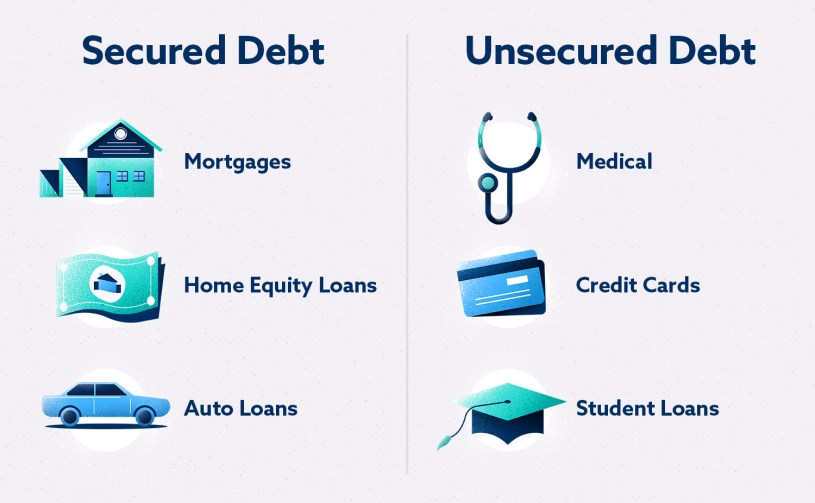

This is why most people see debt settlement as being limited to just unSecured Debt. Sadly, those who see financial obligation settlement in a restricted way includes the consultants in the Secured Debt settlement industry. Their training has actually been restricted to focusing on just unsecured debt, as opposed to a more holistic technique.

Numerous times, debt can avoid us. This is the time to swing into action and attempt to get a plan that can help you lastly escape the financial obligation cycle that has the potential to bankrupt a lot of American Households.

The way this mode of insolvency works is reasonably simple in style and idea. It can be considered a type of liquidation bankruptcy. That means that all possessions that are not exempt will be sold (liquidated) and all monies produced from the sale will then go to those debtors that are owed cash. Obviously, there is more to the process than this but that is the most simplified description of how it works. If the liquidation leads to a total benefit of all financial obligations owed then the person that has actually declared personal bankruptcy security will be Debt Free.

Never ever incur any card debt that is beyond your capability to repay in a single month. That is to state, keep away from Revolving Debt. The card companies make maximum out of the revolving financial obligation only.

Oprah’s Financial obligation Diet has taken America by storm. Because initially aired and enhanced with each new part of the series, millions of Americans are taking the actions needed to begin their course to financial freedom. No matter how you decide you need to tackle it, it is vital that those who require aid start now!

Doing these things will get you financial obligation totally free in time and then you can pay for to purchase that want product you always desired. Nevertheless, don’t do this till your debt is settled. That’s the trick to ending up being financial obligation totally free. Investing just cash that you have and not utilizing charge card and buying just items required not desired.

Or do you understand just how much money you have delegated invest this month? To help you out in this regard, secured financial obligation consolidation loans can be of fantastic aid. So, let’s presume for a minute you have a low rating.

If you are searching exclusive engaging reviews related to Is Installment Debt Better Than Revolving Debt, and chapter 7 Bankruptcy, Warning Signs Of Debt Problems, Easy Debt Consolidations you are requested to subscribe for a valuable complementary news alert service now.