What determines loss given default (LGD)?

Interesting full videos relevant with credit Card Debt Relief, How To Pay Off Debt, Debt Consolidation Company, and Is Unsecured Debt Subordinated, What determines loss given default (LGD)?.

Yesterday I reviewed the beta distribution used to characterize the LGD random variable (recovery/loss conditional on default). According to de Servigny (Chapter 4), the key determinants of recovery are: Seniority, Industry, Business cycle, Collateral, Jurisdiction, and Bargaining power.

Is Unsecured Debt Subordinated, What determines loss given default (LGD)?.

Learning Credit Debt Management – Step By Step To A Debt-Free Life

You will need numerous income sources and a minimum of one of them requires to be recurring.

All financial institutions with unSecured Debt are struggling to discover debt relief.

What determines loss given default (LGD)?, Enjoy most searched high definition online streaming videos relevant with Is Unsecured Debt Subordinated.

Debt Settlement Vs Debt Consolidation

Being financial obligation totally free appears to be just beyond the reach of Americans today. However, depending on just how much debt you have, it will spend some time and effort.

Waking in debt is not something that anyone desires. Owning money to business that will not stop hassling you with telephone call at all hours of the day is enough to make any person tear their hair out. But as a debtor, you have lots of alternatives to tackle abolishing your financial obligation forever. You have actually probably seen all of the websites and advertisements online that will inform you they can wipe your debt clean for simply a couple of cents. While these sites overemphasize excessively, there are ways you can bring your interest rate down and make your financial obligation more manageable.

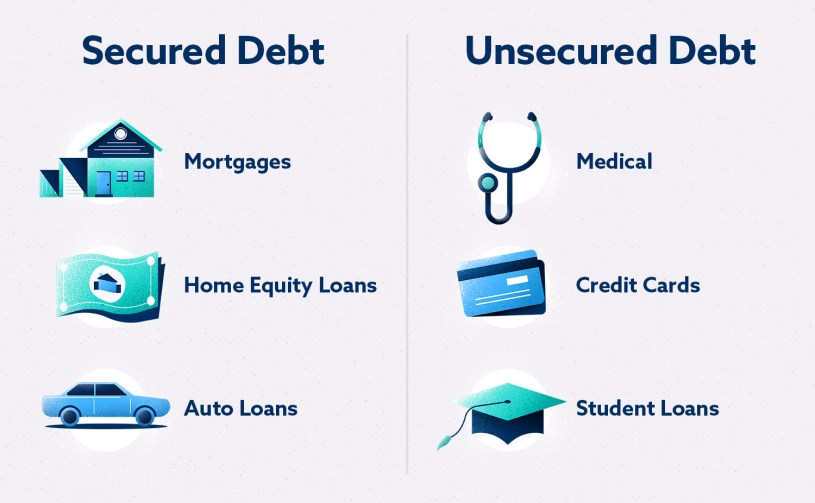

A low rate is really important for you because your objective is to sort out your debt issue. Owing money indicates paying high interest in every installment together with the capital. A Secured Debt debt consolidation loan will provide you flexibility form paying high interest. At the same time it will make your monthly repayment smaller sized. So you can conserve good quantity on every installment.

So how do you reach your goal? The very first thing is to comprehend you require multiple sources of income. You will not get there working one job and earning a linear earnings. You will require several incomes and at least one of them needs to be residual. And one of the best and most popular ways to produce this extra income is with a home based service. Home based business is the trend of the 21st century and is fast becoming the company concept of the future. House business is low threat however high capacity and if you choose an organization that includes mlm, your success will increase a lot more.

A fine example of this remains in the real estate market. With the fall of the market a lot of individuals owe more on their home than its worth. Because you would not make a revenue on your house by selling it, this makes it bad if you are trying to offer. Getting to know what you owe to companies will get you started on your Debt Free life. Just after you understand what you owe can you make a spending plan to fit what you require each month. Since you still want things and this will not be in your budget plan, following a spending plan is extremely difficult at first. Some things have to be paid each month no matter what. You still require your electrical power and gas to live at home. You sure don’t want to stop making your home payment. You would wind up with not having a place to live and this will not help your circumstance.

If you remain in a position where you can make just the minimum month-to-month payments on your Revolving Debt (typically charge card debt), you need to stress – unless it’s just a short-lived scenario. Oftentimes, the required minimum regular monthly payment will be just enough to cover your interest charges and will not do anything to decrease your balances. If you continue to make simply the minimum regular monthly payments needed, you could actually never get out of debt. In one example I saw just recently, the person could get out of financial obligation making simply the minimum monthly payments however it would take him 17 years.

It is constantly much better to decide for an option that does not ruin your prominence permanently. By submitting insolvency one completely ruins their credit rating however with the help of financial obligation relief programs ones repute will be lowered but with the passage of time one can restore their prominence. Most importantly one can end up being a debt free a lot faster and in a more secure method with a future for more loans and credit card use. Whereas bankruptcy would mess up ones image forever and they would never have the ability to take loans once again from any banks.

Concentrate on saving for worthwhile causes. This is the last in the list of 7 clear ideas on how to be debt-free. Purchasing your own home (or a dream house) in the future or preparing for your kids’s university education is leading concern that will assist you to focus and eliminate unneeded expenses. Financial objectives are a way of eliminating temptations to purchase and own less crucial goods and services. Make these objectives reasonable to help make you feel a sense of accomplishment.

There are many factors to consider and much research that requires to be done prior to jumping off of the cliff. After all, that’s what got you into financial obligation in the first place isn’t it?

If you are searching updated and engaging videos about Is Unsecured Debt Subordinated, and secured Debt, Bad Credit Secured Loan, Becoming Debt-free, Secured Debt Consolidation you are requested to join in newsletter now.