Webinar: Invest in Australia to get your Permanent Residence

Latest vids top searched secure Debt, Repair Your Credit, Home Loan Rules, and Secured Debts Must Have Quizlet, Webinar: Invest in Australia to get your Permanent Residence.

Want to stay in Australia? Work with a winning team!

So you’re in Australia and want to stay? It’s hard not to love.

You read all the press commentary on visas going to be harder to get? This will be true.

So general and skilled migration isn’t going to work; so, what will?

Have you thought of an investment visa?

What do I need for an Investment Visa?

1) Have a good idea which is smart and will attract venture capital from a fund and will get approval from a state or territory government to be your sponsor?

2) Do you want to work with smart people who know and can help you through the process?

3) Do you want to work with the team who have a presence in Melbourne, Sydney and Brisbane -so they know the local landscape?

You need a team with the right-skill mix and can work together. You A-team are:

WE are your winning team:

Rincon Migration Lawyers – based in Melbourne

· To advise you on what’s the best Visa for you

Projects RH – located in Sydney

· To prepare corporate documents and investment proposals

River Gold Capital – with offices in Brisbane.

· To introduce you to the capital.

The time to get going is today! Send us your story to info.rca@rincon.com.au

Secured Debts Must Have Quizlet, Webinar: Invest in Australia to get your Permanent Residence.

Terrific Supplemental Income Ideas To Grow Your Debt Payment Fund

Being mostly debt-free does have some disadvantages. Banks can seize the home or possession on which loan is being sanctioned. You must consider a secured debt combination loan.

Webinar: Invest in Australia to get your Permanent Residence, Play new explained videos related to Secured Debts Must Have Quizlet.

How To Get Out Of Financial Obligation Within 6 Months

You won’t get there working one task and earning a linear income. Severe delinquency, negative public record or collection filed – You have a big judgment, collection, or lien. Thus a credit limit is defined for you.

Individuals with excellent credit and high credit scores will not be aiming to discover a cash advance to aid with emergency situation costs. These people will have a savings account or costs space on credit cards to make their spending plans work monthly. Having a high credit report does not indicate a person does not have financial obligation. In truth, financial obligation is a requirement to get a high credit rating.

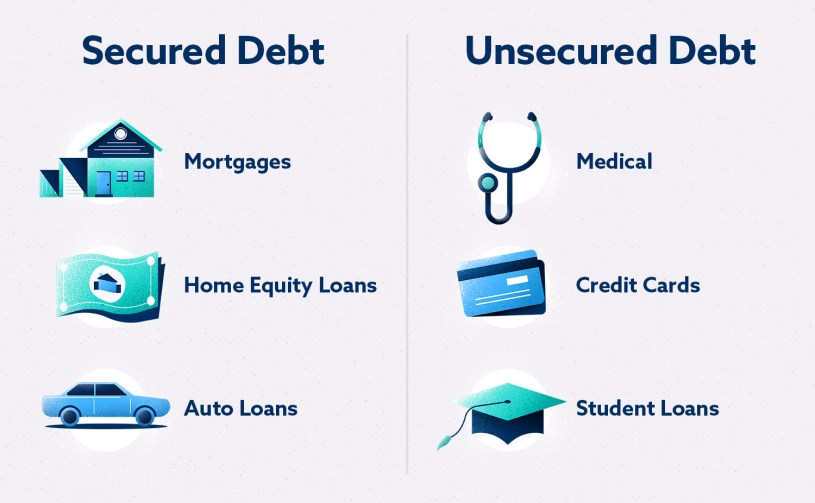

Initially, let’s understand unSecured Debt. Secured Debt is has a concrete item connected to it, such as a home, a car, a boat, a motorbike, or anything else that is used for security. Unsecured financial obligation has no concrete item connected to it for security. The truest example of unsecured financial obligation is charge card debt. This is the first thing that financial obligation settlement business think about when certifying you for debt settlement programs.

Don’t hide your life lessons under a rock. Assist under served segments of society in a way that finest uses your knowledge, abilities, and enthusiasm. No matter what you’ve experienced [bad or good] there is a lesson in it to be shared. Sharing permits providers to open their hearts, establish neighborhoods, and broaden the total well being of society. Returning belongs of the cycle of life. It keeps our souls financial obligation free and opens the heart and hand to eventually get once again possibly even in another way.

Make resign Debt Free priority one when it concerns your objectives in life. Many professionals will tell you to note your financial obligations by interest rate with the greatest rates of interest at the top. This does not work for many. You require to note all financial obligations from tiniest to largest and pay them in that order. Each time you pay one off you will have the motivation to continue working towards ending up being Debt Free.

If you remain in a position where you can make just the minimum monthly payments on your Revolving Debt (usually charge card debt), you require to worry – unless it’s simply a temporary scenario. In a lot of cases, the required minimum regular monthly payment will be just enough to cover your interest charges and will do absolutely nothing to decrease your balances. If you continue to make just the minimum monthly payments required, you might actually never leave debt. In one example I saw recently, the person might get out of financial obligation making just the minimum month-to-month payments however it would take him 17 years.

One payment versus many payments: The average citizen of the USA pays 11 different financial institutions monthly. When, making one single payment is much simpler than figuring out who must get paid how much and. This makes handling your finances a lot easier.

When you are financial obligation free, imagine what you will have. Just how much additional money will you have when you are not paying all that financial obligation. Envision the much better life you stop wasting massive quantities of money on interest payments.

The creditor wants you to keep their card and continue costs. Others state to settle your highest interest rate initially. Not to discuss that cooking from scratch is good for your health, too.

If you are looking updated and entertaining comparisons about Secured Debts Must Have Quizlet, and debt Management, Past Due Credit Card Debt, Financial Freedom you are requested to subscribe for email subscription DB for free.