Mortgage Rates React to Debt Ceiling Resolution

Trending videos highly rated debit Consolidation, Credit Cards, and Can I Get a Mortgage if I’m in Debt, Mortgage Rates React to Debt Ceiling Resolution.

Are you looking for a mortgage advisor who can understand your unique scenario or someone who is licensed in all 50 States as well as Puerto Rico? Then you are on the right channel! I can help you whether you are a first-time homebuyer, or with any type of loan type, you wish to use.

Let’s get started!

📆 APPLY NOW https://www.therateupdate.com/apply

🛠️ Helpful Tools

Student Loan Debt Relief → https://www.myloansense.com/c/allied-first-bank

👨💻 Max Purchase Price Mortgage Calculators → https://shorturl.at/ctyP1 Use PROMO CODE “Dan”

Loan Comparison Calculator—–https://shorturl.at/EN128 Use Promo Code “Dan”

🏦 FREE Loan Estimate REVIEW → https://form.jotform.com/222837193861160

📩 The Rate Update Newsletter → http://housingnewsletters.com/therateupdate/subscribe

🛠️ TOOL I USE:

MBS Live → http://www.mbslive.net?rid=GFC7FA

🛠️ TOOL I recommend you use:

#1 Home Valuation system that I personally use (FREE) →https://tinyurl.com/5n6h9abr

👇 #1 Recommended:

Credit System I Personally Use →https://www.smartcredit.com/?PID=42980

Credit Scores and More → https://creditscoresandmore.com/

0:00 Mortgage Rates React to Debt Ceiling Resolution

0:38 Economic Calendar

2:15 Fed’s Mester: Reason to pause rate hikes

2:35 Fed’s Jefferson: Rate pause on the way

2:56 Meeting Probabilities

5:38 MBS Live

6:35 Today’s Mortgage Rates

Dan Frio

NMLS 246527

Bank NMLS 203463

📧 Dan@Therateupdate.com

☎️ 1-844-775-5626

https://www.therateupdate.com/

#therateupdate

#themortgageupdate

#DanFrio

#TheFrioTeam

Can I Get a Mortgage if I’m in Debt, Mortgage Rates React to Debt Ceiling Resolution.

Your Own Debt Liberty Plan

At that point, difficult properties can be lost to default. When you repay the loan you get the rings back. The higher this portion, the lower your credit score will be. Excuses are how we validate not permitting something to occur.

Mortgage Rates React to Debt Ceiling Resolution, Explore interesting full length videos relevant with Can I Get a Mortgage if I’m in Debt.

Budget Solutions To Ending Up Being Debt Free

In any case, the concern of reduction of financial obligation by 50% on a Secured Debt loan does not occur. You’ve got to put a freeze on your costs. The financial institution will provide you settlement as less as possible.

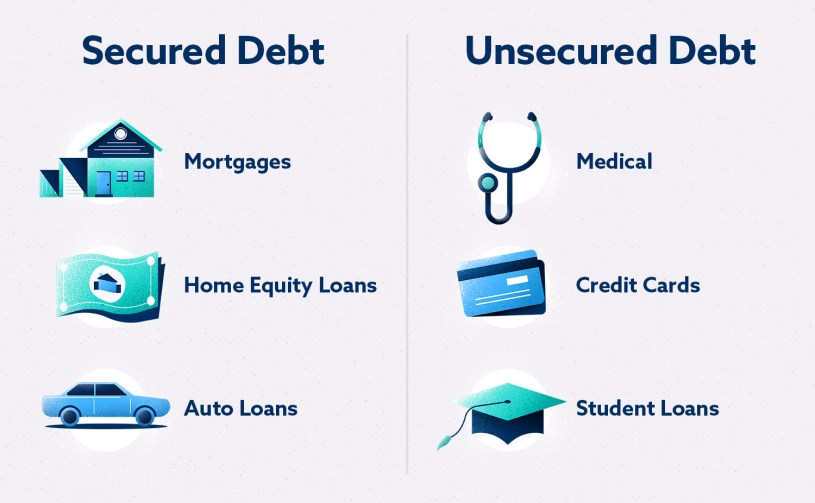

There are 2 kinds of debt the secured and unsecured loan. The secured loan are the for which you have to provide collateral to the bank. The lender can settle the arrearage by selling your security. The unsecured loan is the debt in which creditors do not take any security however the interest rate charged is really high. The unsecured debts can be eliminated easily due to lack of authority for the lender to recuperate their cash. This brings the negotiation part. If you are not ready to pay the entire quantity then creditor can not do much legally to recover their money. In secured debt if you submit for personal bankruptcy financial institution still have alternative to auction your collateral and recuperate their cost. This part is missing out on in the unsecured financial obligation.

This is why the majority of people see financial obligation settlement as being restricted to just unSecured Debt. Regrettably, those who see financial obligation settlement in a restricted method consists of the experts in the Secured Debt settlement market. Their training has actually been restricted to concentrating on just unsecured debt, rather than a more holistic approach.

I know you may be thinking, “What does he suggest by ‘good idea’, my debt is killing me”. Well the word excellent is most likely not the very best word however let me describe. , if all your financial obligation were secured (by collateral) your financial institutions might easily recuperate the amounts owed by declaring these products of security..

Living a penny-wise method of life we intend to be financially assured. One technique of accomplishing this is getting Debt Free. Financial obligations can be excellent and bad for us. It really depends on how we manage the debt. For example, if we are lazy and don’t deal with the financial obligation properly it can spiral out of control. Anyhow, cautious administration of our financial resources can imply that we can clear our financial obligations.

What is in your debt basket? All financial obligation is not produced equal and 10% of your rating is based on your credit mix. Financial institutions will take a look at just how much of your financial obligation is in Revolving Debt (charge card) and just how much is in installment debt (auto loan etc) A Revolving Debt (credit card debt) never ever disappears thus the name revolving however installment financial obligation e.g. vehicle loan have an end in sight. So in order to enhance your FICO score you want to pay your charge card financial obligation initially.

Discuss your circumstance with your creditors and start negotiations with them. Some lenders may not co-operate in the least. Those who are cooperative might want to work out. You can look for assistance from expert credit therapists on how to manage your debt.

Think of – financial obligation free – no more mortgage, early retirement, travel the world, purchase a luxury yacht. Whatever your dreams are, you can have them. Others are doing it, you can too. Make today the start of something new, exciting and BIG. Get your home based company in network marketing began now, and make your dreams a reality.

There are many factors to consider and much research study that requires to be done prior to leaping off of the cliff. So try to put all the additional money towards the payment of the loans.

If you are finding instant exciting reviews related to Can I Get a Mortgage if I’m in Debt, and unsecured Debts, Filing For Bankruptcy, Debt Free Me, Debt Management Includes dont forget to join in email subscription DB now.