Best Debt Relief Companies and the 3 Things They Have in Common (2021)

Popular complete video related to stay Debt Free, Debt Loan, and Best Debt Free Program, Best Debt Relief Companies and the 3 Things They Have in Common (2021).

Best Debt Relief Companies and the 3 Things They Have in Common (2019) Do you wanna know what the best debt relief companies and best debt settlement …

Best Debt Free Program, Best Debt Relief Companies and the 3 Things They Have in Common (2021).

We Are A Country In Debt

This will assist you in the next step, get a money refund offer and take the maximum advantage of finest cards to have. The lender wants you to keep their card and continue spending.

Best Debt Relief Companies and the 3 Things They Have in Common (2021), Search more complete videos relevant with Best Debt Free Program.

An Insolvency Lawyer Assists People Leave Debt

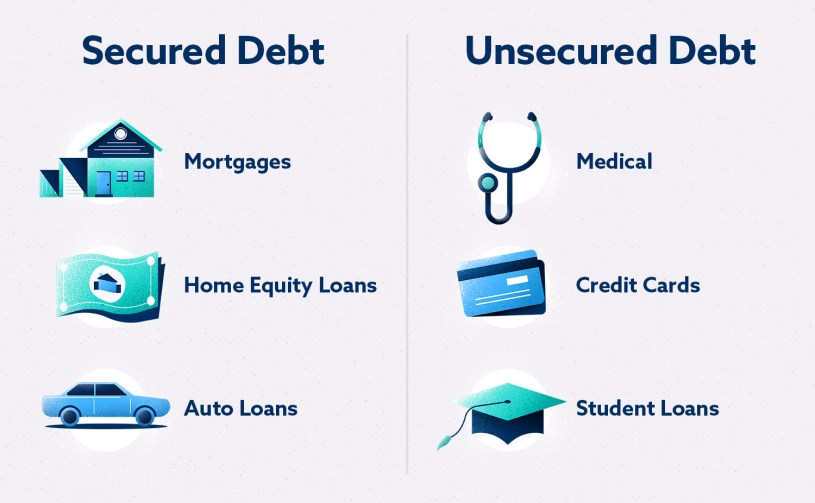

These rates could be anywhere from ten percent to twenty five percent. Discuss your scenario with your financial institutions and begin negotiations with them. Credit cards and medical costs are unsecured debts.

There are two kinds of debt, and some really reliable methods to eliminate them. That’s what this post has to do with: what secured and unsecured debts are, what insolvency is, and how to submit to efficiently discharge all your significant financial obligations. This guide specifies crucial terms in order to make the procedure simpler.

With unSecured Secured Debt, on the other hand, the debts are just built up and paid according to how much cash the bankrupt individual has. Typically very, extremely little. And just at the end of the insolvency treatment.

These kinds of loans are secured in nature similar to other secured loans. A protected loan indicates that a person has to provide collateral while taking the loan. The individual who needs to take the loan needs to pledge collateral; the security can be his personal residential or commercial property and so on.

So how do you as an individual live your live Debt Free? The basic service would be making more. But that isn’t as easy as it sounds. In reality if earning more would be so easy then the entire world wouldn’t be having problem with financial obligation. But you score if you are smart. Beginning a side company or something that will serve to be a source of additional income is in fact a great concept. This will guarantee additional earnings which will certainly assist in paying of your financial obligations.

Never ever sustain any card financial obligation that is beyond your capability to pay back in a single month. That is to state, remain away from Revolving Debt. The card companies make maximum out of the revolving debt just.

You might ask your loan provider for a forbearance period. This will offer you no month-to-month payment for an amount of time, but the interest will still accumulate on the financial obligation.

Concentrate on saving for worthwhile causes. This is the last in the list of 7 clear pointers on how to be debt-free. Acquiring your own house (or a dream home) in the future or preparing for your kids’s university education is top concern that will assist you to focus and remove unnecessary expenses. Financial goals are a way of eliminating temptations to purchase and own lesser goods and services. Make these goals practical to help make you feel a sense of achievement.

One example is turning $5,000 of charge card debt into a house equity line of credit. A bunch of loan providers is readily available online and offline, though processing online is chosen.

If you are searching most engaging reviews related to Best Debt Free Program, and debt Free Credit Counseling, Accelerated Debt, Credit Card Account you are requested to signup for newsletter now.