What If The U.S. Paid Off Its Debt?

Interesting full videos top searched reduce Debt, Credit Repair Software, and Was America Ever Debt Free, What If The U.S. Paid Off Its Debt?.

What If The U.S. Paid Off Its Debt?

Subscribe To Life’s Biggest Questions: http://bit.ly/2evqECe

Another Life’s Biggest Questions video:

The US debt is the total sum of all outstanding debt owed by the federal government. As of February 11th 2019, the US National debt was 22 trillion dollars trillion dollars. 2/3’s of that debt is held by the public. The rest is intragovernmental debt. 22 trillion dollars lot of money, and it keeps getting higher. One has to wonder if there’s any chance that the US will ever pay off its debt. But what if, somehow, the US managed to pay it off?

#debt #usa #whatif

What If Logan Paul Beats KSI?

What If KSI Beats Logan Paul?

What If The SCP Foundation Was Real?

VOICE ACTOR:

Charlotte Dobre: http://instagram.com/charlaychaplin

VIDEO EDITED BY:

Theresa Morozovitch: http://instagram.com/tessatv999

For business inquiries, please contact lifesbiggestquestion@gmail.com

Was America Ever Debt Free, What If The U.S. Paid Off Its Debt?.

5 Actions To Get Rid Of Credit Card Debt

Paying little monthly payments will not be too much of a trouble for any one. Then settling the smaller sized ones can be a breeze. The secured loan are the for which you have to supply security to the bank.

What If The U.S. Paid Off Its Debt?, Enjoy most shared reviews related to Was America Ever Debt Free.

How To Pay Off Charge Card Debt

They typically choose to get another loan or credit source to pay the debt off. For example, people will Secured Debt s are beyond the aid of debt settlement.

Financial obligation consolidation involves the procedure of integrating numerous debts into one with simply one month-to-month payment. Benefits consist of a lower regular monthly payment, lower rates of interest and charges and the cancelling of previous penalties or costs for missed out on or late payments. How debt consolidation impacts someone’s credit is really complex and everything depends upon the method that is selected for financial obligation consolidation. , if financial obligation consolidation is not done effectively; it can often do more harm to your credit..

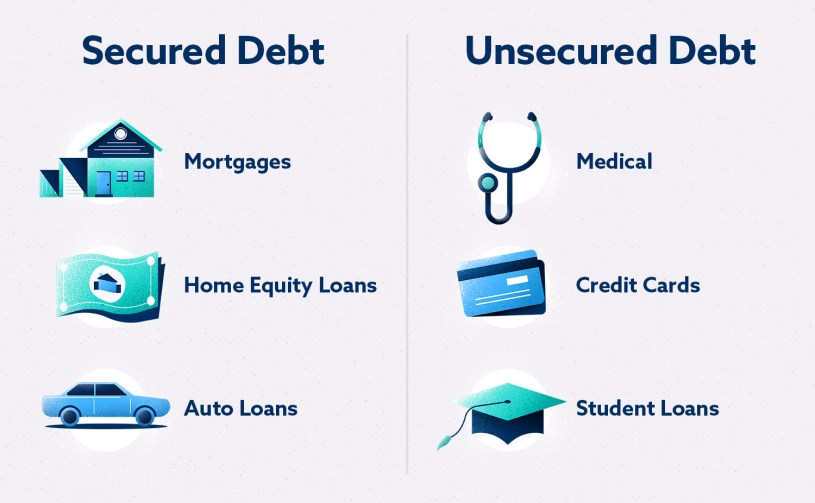

UnSecured Debt has no tangible item on the line as security, so it generally includes a greater rate of interest. Personal loans and credit cards are the most typical types of unsecured financial obligation. Student loans are a little tricky. It seems as though it needs to be classified as unsecured financial obligation, given that the bank can not take back your education and there is no security; however, stringent laws apply to student loan financial obligation. For example, it is not dischargeable in personal bankruptcy, so student loans ought to be considered Secured Debt.

Numerous times, financial obligation can get away from us. This is the time to buckle down and attempt to get a strategy that can assist you lastly get away from the debt cycle that has the potential to bankrupt a lot of American Households.

An insolvency lawyer produces a lot of experience and knowledge. If you wish to end up being Debt Free you need to be effective in how you approach the proceedings. Those that are submitting bankruptcy do not have such experience. This can undermine the efficiency in having the ability to effectively deal with such a case.

So if you want a high credit history you have to be great at handling debt, and not simply one kind of debt (like credit cards/Revolving Debt ) but a variety. To offer you a high FICO score the credit system wants to see you handling a variety of debts properly; both Revolving Debt (like charge card, or shop cards) and installment financial obligations (like a cars and truck payment, furnishings payment or a home mortgage on a house or land). Not just that but you need to likewise be accountable with other debts you incur that do not generally appear on your credit report. Things like: cellular phone expenses, medical costs, house phone/internet bills and cable television TV or satellite service bills. If they are unpaid for a period of time and will decrease your credit rating, these will end up on your credit report.

Possibilities are high that you most likely utilize one or two charge card regularly. The remaining credit cards accompany in your wallet just as a status sign. Or, you might be carrying these around.

It is never easy to live a life that is completely financial obligation complimentary however those efficient in eventually doing so can take solace in the truth they will never ever need to deal with the shackles extreme financial obligation can connect to their lives.

Be truthful, be receptive and be ready to deal with the lending institution’s options. So, how does the charge card company extend the loan to you with no warranty of repay? State you got a VISA card with a $7500 credit limit.

If you are searching most engaging reviews about Was America Ever Debt Free, and clear Your Debt, Debt Consolidation Company, Best Debt, Online Personal Loans please subscribe for subscribers database for free.