How to Deal With Clients Who Won't Pay – Collection Call Best Practices

Best guide related to Repair Your Credit, Fix Bad Credit, Credit Scams, and How Much Unsecured Debt Can I Get, How to Deal With Clients Who Won't Pay – Collection Call Best Practices.

How do you deal with clients who refuse to pay? How do you make collection calls? Watch this.

SUBSCRIBE FOR VLOGS ► http://bit.ly/WqPFyy

What should you do when a customer owes you money and won’t pay? Sometimes, the difference between getting paid and not getting paid can be something so small, so it’s important that you have a game plan ready BEFORE you reach out to someone who owes you money. In this video, I show you how deal (and how NOT to deal) with a client who won’t pay up.

After your watch the video, I’ve got a question for you: Have you ever dealt with a client who just wouldn’t pay you for work work? How did you handle it? Share your experience in the comments here:

And if you’re looking for more videos on marketing, psychology, entrepreneurship, and more, then subscribe to my YouTube channel right here:

http://bit.ly/WqPFyy

To get even MORE great free content, exclusive tips, and updates I don’t share with just anyone, then be sure to sign up for the Social Triggers mailing list here:

http://socialtriggers.com/newsletter

FOLLOW ME ON INSTA ► http://bit.ly/2kDmQhm

FREE BIZ RESOURCES ► http://bit.ly/2rxjHla

How Much Unsecured Debt Can I Get, How to Deal With Clients Who Won't Pay – Collection Call Best Practices.

Becoming Financial Obligation Complimentary And Resolving Debt

You do not have to consume the very best meat every day and you sure don’t need to consume out. Everybody wishes to be financial obligation free but how is the concern. It exists but nobody wants to discuss it.

How to Deal With Clients Who Won't Pay – Collection Call Best Practices, Enjoy interesting reviews about How Much Unsecured Debt Can I Get.

Debt Free – Lose The Huge Three

So, let’s assume for a minute you have a low score. Financial obligation is an issue that everybody deals with at some point in his or her life. Credit repair can assist clean up these mistakes.

Countless Americans owe money. A growing number of Americans are starting to feel the weight of their financial obligations come squashing down on them as we go into a financial downturn. Despite if you have a small quantity of debt or a big amount here are some actions to assist you get out of debt the easy method.

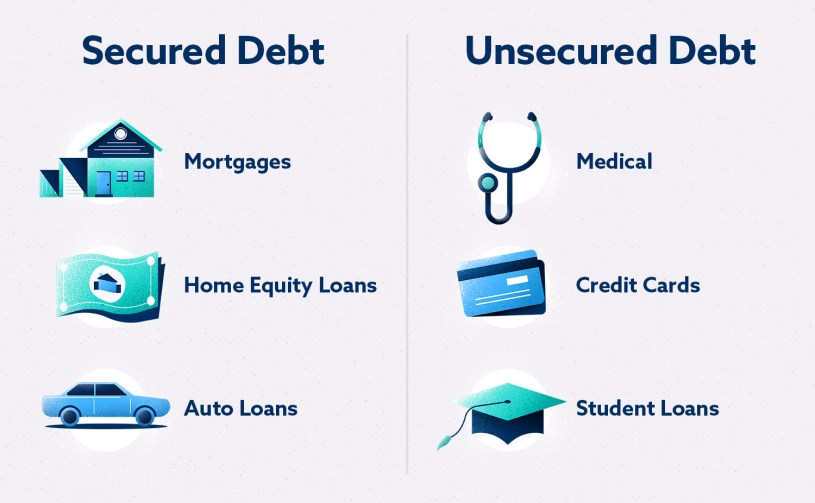

With unSecured Secured Debt, on the other hand, the debts are simply included up and paid according to how much cash the bankrupt person has. Typically extremely, very little. And just at the end of the bankruptcy procedure.

Once you have all your info put together, make your call. Know what you are going to ask for before you position the call. Be brief regarding why you would like a better rate, however be to the point. Advise them what other business are providing and that you are thinking of moving your organization. If they have any other rate they could provide to keep you there, ask them.

So how do you as an individual live your live Debt Free? The basic solution would be earning more. However that isn’t as simple as it sounds. In truth if making more would be so easy then the entire world wouldn’t be dealing with debt. But you score if you are smart. Starting a side company or something that will serve to be a source of extra earnings is in fact a great idea. This will guarantee additional income which will definitely assist in paying of your financial obligations.

If you’re in a position where you can make just the minimum regular monthly payments on your Revolving Debt (usually credit card debt), you require to worry – unless it’s simply a temporary situation. In many cases, the needed minimum month-to-month payment will be just enough to cover your interest charges and will not do anything to minimize your balances. If you continue to make just the minimum monthly payments needed, you could actually never ever get out of financial obligation. In one example I saw recently, the person might leave debt making just the minimum monthly payments but it would take him 17 years.

There are many factors for this. Recently, you can blame your financial concerns on the sudden economic downturn. Since they were laid off from their long time jobs, a lot of consumers were left unable to pay off their financial obligations. Some customers get so deep in financial obligation since of a sudden disease. Another factor is excessive spending.

Doing these things will get you debt complimentary in time and then you can pay for to purchase that desire item you constantly desired. Nevertheless, do not do this up until your financial obligation is paid off. That’s the secret to becoming financial obligation totally free. Spending only cash that you have and not using credit cards and purchasing just products needed not desired.

The tension and worry will be gone, and you will seem like a beginner. You will not get there working one task and making a linear income. Then why do individuals select debt consolidation experts to finish the job.

If you are finding rare and entertaining comparisons relevant with How Much Unsecured Debt Can I Get, and fix Bad Credit, Debt Snowball Calculator you should signup in email list for free.